Monetary Policy Statement -December

MPC or the Monetary Policy Committee is comprised of six members and is responsible for fixing the benchmark interest rate in India. The main duty of the Monetary Policy Committee (MPC) is to set the policy repo rate with the goal of reaching the desired inflation rate, all while taking into account objectives related to economic growth. The RBI MPC comprises six members, including both external individuals and officials from the Reserve Bank of India.

Committee Members:

- Governor of the Reserve Bank of India – Chairperson, ex officio – Shaktikanta Das

- Deputy Governor of the Bank in charge of monetary policy – Michael Debrata Patra

- Executive Director of the Bank in charge of monetary policy – Rajiv Ranjan

- Ashima Goyal is a member of Prime Minister Narendra Modi’s economic advisory council. Ms Goyal is a professor at the Indira Gandhi Institute of Development Research in Mumbai and was a visiting fellow at Yale University.

- Shashanka Bhide is a senior advisor at the National Council for Applied Economic Research, a New Delhi–based think-tank, whose work has involved research into agriculture, poverty analysis and macroeconomics.

- Jayanth Varma is a finance and accounting professor at the Indian Institute of Management, Ahmedabad. He was formerly on the board of the country’s capital markets’ regulator.

Highlights from the December meeting of MPC.

The MPC met recently in December for a 3-day meeting from 6 to 8 December. The various important decisions taken during this meeting were:

- They decided to keep the main interest rate (repo rate) unchanged at 6.50%.

- Other related rates, like the standing deposit facility (SDF) rate and the marginal standing facility (MSF) rate, were also kept unchanged.

- The committee wants to focus on gradually reducing support to the economy to control inflation while still helping economic growth.

Assessments and Outlook of the Committee:

- Globally, economic growth is slowing in different countries. Inflation is going down, but it’s still a bit higher than the target. Things have improved in financial markets.

- In the country, the economy is doing okay. The GDP (a measure of economic growth) grew by 7.6% recently, thanks to investments and government spending.

- The committee expects improvements in manufacturing, construction, and rural areas, which should boost people’s spending. Banks and businesses are doing well, and they expect more investments. However, there are some risks from international issues.

- Inflation (the increase in prices) has gone down a bit, but there might be some increases later due to uncertainties in food prices and global oil prices.

Predictions for the next Quarter:

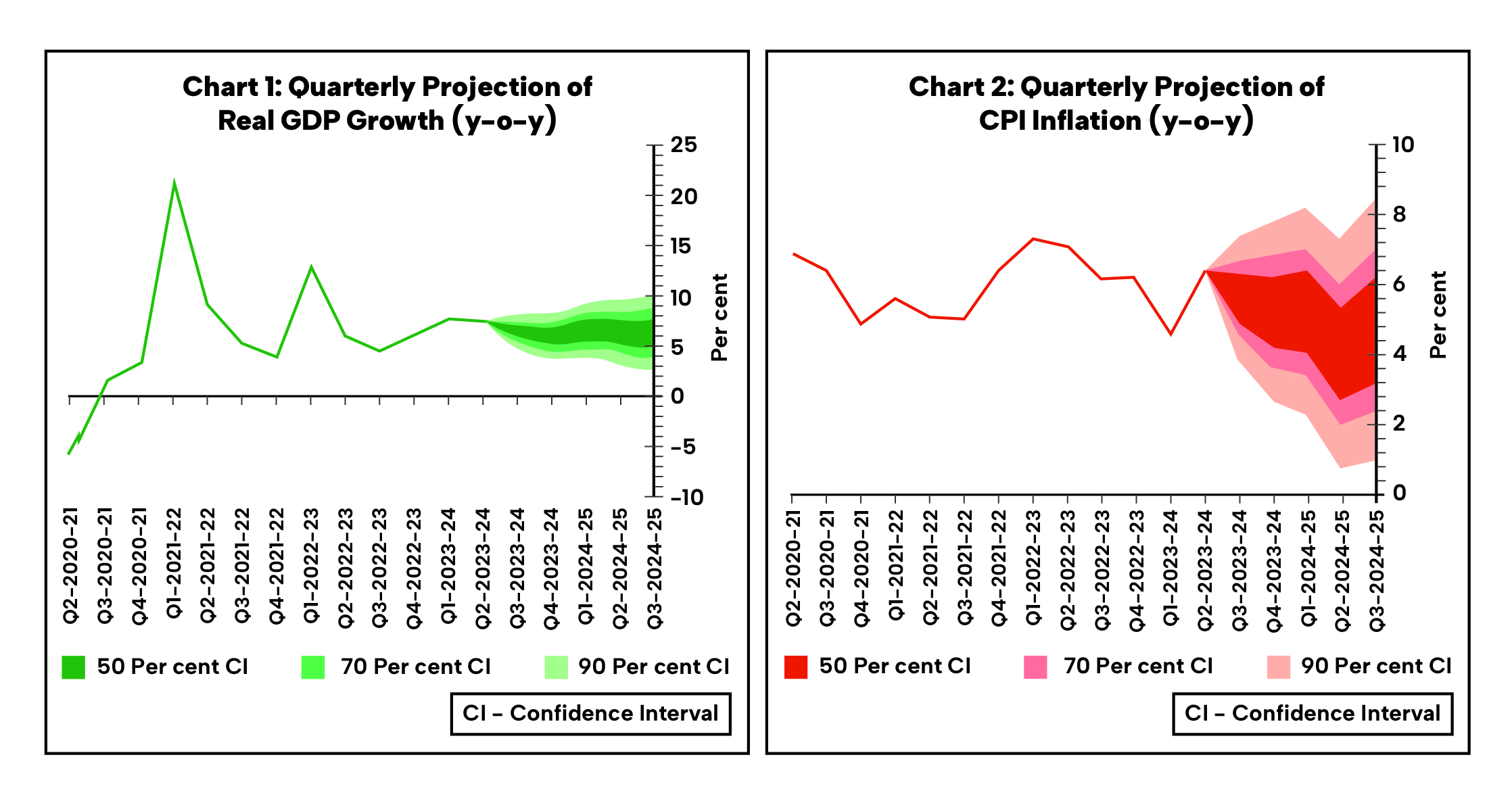

The economic growth, measured by real GDP, is expected to be 7.0% for the year 2023-24, with a decrease to 6.5% in the third quarter (Q3) and further to 6.0% in the fourth quarter (Q4). Moving into the next fiscal year (Q1:2024-25), growth is anticipated to be 6.7%, followed by 6.5% in Q2 and 6.4% in Q3.

In terms of inflation, the Consumer Price Index (CPI) is estimated to be 5.4% for the year 2023-24, with a slight increase to 5.6% in Q3 and a decrease to 5.2% in Q4. Assuming normal monsoon conditions in the upcoming year, CPI inflation is projected to be 5.2% in Q1 2024-25, followed by a decrease to 4.0% in Q2 and a further decrease to 4.7% in Q3.

Conclusion

In summary, the recent Monetary Policy Committee (MPC) meeting maintained the repo rate at 6.50%, emphasizing a gradual withdrawal of economic support. Globally, economic growth is slowing, but India’s GDP grew by 7.6%, led by investments and government spending. The committee foresees improvements in manufacturing, construction, and rural sectors, but international risks persist. Inflation, currently at 5.4%, may see slight fluctuations. Projections suggest GDP growth of 6.7% in Q1:2024-25 and CPI inflation of 5.2%. The MPC’s decisions reflect a cautious approach to balance inflation control and economic growth amid evolving global and domestic challenges.